Gambling is an extremely popular activity in Canada, with the industry ranking in the Top 5 for global performance. It is estimated that more than 70% of adults regularly engage in some form of gambling, whether that is sports betting, playing lotteries, or visiting casinos.

Canada has always had a liberal approach to gambling, with both land-based gaming and online casinos permitted to operate. Online casinos are licensed by the Kahnawake Gaming Commission, based just outside Montreal, which ensures that players get access to the best quality sites, such as this casino online by JackpotCity.

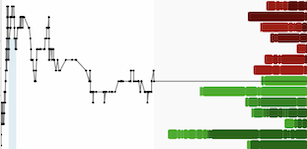

Many of these operators are also floated on the stock market, allowing Canadian’s to back local companies by purchasing stocks. With use of online casinos on the rise, it is unsurprising that gambling stocks have been performing highly over the past few years. Here is a quick recap of the top 3 performers so far:

Great Canadian Gaming (GC)

Based in North York, Great Canadian Gaming has been running gambling operations since 1982. They currently operate 25 facilities over four provinces and offer over 16000 slot machines and 575 table games across their premises. Their casinos and hotels also offer dining facilities and rooms.

One of the more expensive stocks, they are showing a year-to-date rise of 1.61% and have a market capitalization of $2.55 billion. A big company, they are a consistent performer and although land-based venues had a difficult 2020, they are still going strong.

Evergreen Gaming Corporation (TNA)

A much smaller operator, Evergreen Gaming are based in the US and operate venues around the state of Washington. So far, they have three casinos in operation offering a variety of table games including Baccarat, PaiGow, Poker, and Blackjack, as well as restaurant and bar facilities.

Evergreen Gaming’s stocks are one of the cheapest gambling stocks available, so any gain will not net you a massive instant profit. However, they have already registered a growth of 10.34%, showing that they are a company on the rise. Getting in the door now could see you cash in in the long run.

Pollard Banknote Ltd (PBL)

Pollard Banknote has been operating out of Winnipeg for more than 100 years. They provide gambling equipment on a rental or purchase basis, with their stock including lottery- and bingo-related products. More recently the company has branched into online services, offering interactive digital games as well as website development.

The biggest winner this year so far, Pollard Banknote has seen a 57.25% rise in their stock’s value, with the unit price now the highest of all Canadian gambling stocks.

In Summary

With 2021 not even halfway done, there is still plenty of opportunity for these stocks to continue to grow and improve. With interest in online gaming continuing to rise, there is every confidence that gambling stocks are going to be top performers for a long time to come.