Six out of ten Canadians partake in monthly gambling of some form placing Canada fourth on the list of countries spending the most in the sector. At the time of writing there are 88 land-based casinos in Canada, and citizens are at liberty to gamble at a number of offshore online casinos that accept Canadian players.

The law surrounding online casinos in Canada is not as straightforward as in some other countries. Legally, casinos cannot operate if the servers are located on Canadian soil but offshore sites based in the Isle of Man, Gibraltar, Malta and Cyprus accept Canadian players.

Furthermore, the native territory of Kahnawake has their own Gaming Commission that licenses both online and land-based casinos. Spin casino is an example of a provider with licenses from both Malta and Kahnawake. The online casino is regulated by the Malta Gaming Authority, a worldwide established gaming license company.

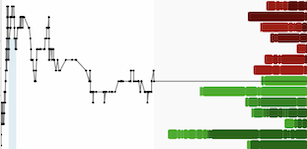

The combination of a disposed general public and sufficient regulatory space has and will continue to have a positive effect on Canadian casino stocks. The best performing Canadian gaming/gambling stocks at present are:

- Pollard Banknote Limited (PBL)

A printing company for government lotteries in North America and the rest of the world. With a market cap of $1.38 billion CAD and a 43.82% price change increase in the year to date, PBL is a solid investment.

- Great Canadian Gaming Corporation (GC)

Operating 25 facilities across the country including casinos, hotels and theatres GC Gaming is one of the largest gaming companies in the province. Based out of British Columbia, they now possess a market cap of $2.56 billion CAD and with a recent takeover bid by Apollo Global Management Inc. given the green light there is an element of uncertainty (and potential to make profit) in the near future.

- Gamehost Inc. (GH)

A much smaller market cap of only $188 million CAD compared to GC Gaming, Gamehost is Alberta’s hospitality and gaming leader, operating slot machines, lottery terminals and table games at their facilities. Riskier than more established options in an already volatile sector, the investment has the potential to go either way.

Recently, bill C-218 passed in the Senate which will signal the legalization of single-event sport gambling. The upper chamber approved the bill in June 2021 and will become law once royal assent is approved.

The adoption of this landmark act will expand the betting and gaming industry hugely as well as generating billions in revenue for Provincial governments that regulate gambling. It will mean the money that was once spent on offshore sites will now be able to be regulated on home turf and the domestic stock market is likely to respond accordingly.

The gaming sector for the longest time has been a steady up and up investment. However, recently some dyed in the wool stalwarts have been not only underperforming but even losing value. Burgeoning companies adopting new technologies can be undervalued and while carrying a touch more risk might pay attractive dividends. Either that or pick out the well-established companies that have their sights set expanding their operations.