Original Article: https://www.juniorstocks.com/rising-geopolitical-tensions-push-minor-metals-to-the-forefront

How Geopolitical Instability is Driving Demand for Critical Metals Essential to Modern Warfare

The global defense sector is experiencing an unprecedented surge, reaching record highs driven by instability and escalating conflicts across multiple regions of the world. The ongoing war in Ukraine, mounting tensions between Israel and Iran, and the escalating military presence in the Taiwan Strait are just a few examples fueling this surge. Alongside these growing tensions, the rise in global defense spending has brought minor metals into sharp focus. But why do these metals matter? Let’s dive in.

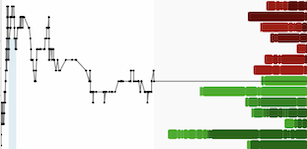

Rising Geopolitical Tensions and Defense Stocks

The world is increasingly on edge. Geopolitical tensions are at their peak, with conflicts raging in Europe, the Middle East, and parts of Asia. The war in Ukraine has dragged into its second year, with no clear resolution in sight, while North Korea’s actions in blowing up key infrastructure with South Korea have further increased concerns about regional stability.

Defense companies are benefitting from this environment of instability. The SP Aerospace and Defense Select Industry Index has reached new highs, closely followed by the STOXX Europe Total Market Aerospace and Defense Index. Investment insights suggest that these surges are primarily due to heightened demand for military products, ranging from conventional weapons to state-of-the-art aerospace technologies.

Minor Metals - The Unseen Drivers of Modern Warfare

Minor metals are a category of metals that are lesser known but vital in a range of high-tech applications, including the defense industry. What makes these metals unique is the fact that they operate in small, opaque markets, which makes them incredibly volatile. Even a minor shift in demand or supply can lead to significant price swings.

Minor metals are crucial to modern military technology, especially in developing advanced weaponry, aerospace components, and electronic systems. These metals have distinct properties, such as high strength, resistance to extreme temperatures, and excellent electrical conductivity, making them irreplaceable in defense applications.

Key Minor Metals and Their Strategic Role in Defense

Antimony - The Armor Hardener

Antimony is used primarily as an alloying agent in ammunition, hardening lead bullets and enhancing their performance. Additionally, its flame-retardant properties make it vital for military-grade explosives and protective clothing.

China accounts for nearly half of the global antimony production, making it a strategic resource that is vulnerable to supply chain disruptions. Companies like Military Metals (CSE: MILI, OTC: MILIF) provide direct exposure to antimony, which is critical for national defense.

Tin - The Backbone of Military Electronics

Tin plays a critical role in the defense sector, particularly in the production of solder for electronics used in communication systems, radar, and advanced weaponry. The military’s reliance on advanced electronics makes tin an indispensable metal.

China produces approximately 40% of the world’s refined tin, giving it considerable leverage over the supply of this critical metal. Alphamin Resources (TSX: AFM) is one of the primary companies involved in tin production, although the geopolitical risks associated with its operations in the DRC remain a concern.

Tungsten - The Armor-Piercer

With its exceptionally high melting point and density, tungsten is indispensable for manufacturing armor-piercing projectiles and aerospace components. Its heavy density makes it ideal for penetrating armor, giving it a strategic edge in combat.

China dominates the tungsten market, accounting for over 80% of global production. Any geopolitical shift that affects China’s tungsten supply could have profound implications for defense industries worldwide.

Rare Earth Elements - Critical for Advanced Systems

Rare earth elements (REEs), such as neodymium, dysprosium, and samarium, are essential in producing high-performance magnets used in precision-guided weapons, jet engines, and communication systems.

The global supply of REEs is heavily dominated by China, which has made security of supply a national defense issue for many countries. The strategic importance of REEs cannot be understated, as these materials are at the heart of modern military technologies.

Supply Chain Vulnerabilities and the Geopolitical Risks

China’s dominance in the production of key minor metals, including rare earth elements, cobalt, and tungsten, represents a significant vulnerability for defense sectors worldwide. Any trade restriction or conflict involving China could lead to major supply chain disruptions, affecting the availability of these critical metals.

In 2010, China’s restrictions on rare earth exports served as a wake-up call to the world about the risks of over-reliance on a single nation for essential resources. The effects were felt across industries, particularly in the defense sector, highlighting the need for diversified supply chains.

Growing Military-Industrial Demand for Minor Metals

As military technology evolves, the demand for minor metals is rising. Hypersonic weapons, drones, advanced radar systems, and space-based military assets all rely on a combination of tungsten, rare earth elements, and niobium. These technologies represent the future of warfare, and securing the metals that make them possible is becoming increasingly crucial.

Defense budgets in major nations, including the US, China, and Russia, are on the rise, signaling a growing demand for materials critical to military technologies. The complexity of modern warfare is pushing nations to secure stable supplies of these critical metals, which could drive prices higher in the coming years.

The Future: Resource Wars and Global Tensions

The future is likely to witness increased competition for control of critical resources, similar to the oil disputes of the past. Minor metals like cobalt, tungsten, and rare earths are becoming increasingly vital, and nations may resort to extreme measures to secure their supply.

The South China Sea is not just a geopolitical hotspot for territorial claims but is also rich in untapped mineral resources, including rare earth elements. As global tensions continue to rise, the strategic value of these resources will grow, potentially leading to further conflicts over control.

Investment Opportunities in Minor Metals

Antimony, Tin, and Tungsten - Investment Prospects

Given the current geopolitical environment, metals like antimony, tin, and tungsten present unique investment opportunities. Companies like Military Metals, Alphamin Resources, and other mining firms are positioning themselves to benefit from increasing military demand.

Diversifying Metal Supply Chains

Investors have an opportunity to capitalize on projects that seek to diversify the supply of these metals. Diversifying supply chains is a critical component in reducing vulnerabilities, particularly in light of the ongoing tensions involving China and other key producers.

Conclusion

Minor metals are rapidly becoming the backbone of the global defense sector, powering everything from munitions to advanced radar systems. With the defense sector reaching record highs, the demand for these essential resources is only expected to grow. The concentrated nature of their supply, particularly from regions like China, poses a significant risk to defense industries worldwide. However, for investors, this represents a rare opportunity to capitalize on projects that have the right exposure to these critical materials. In a world fraught with instability, ensuring the availability of minor metals may very well become the next frontier in maintaining national security.