2020 has been a remarkable year by all accounts. We have also seen incredible volatility across financial markets, with fortunes changing drastically between January and March. Since the March lows we have witnessed some stunning rallies across markets, sectors, and asset classes. One of the junior mining companies that saw its fortunes change negatively from January to March, only to reverse higher in terrific fashion during the summer is Vizsla Resources (TSX-V:VZLA, OTC:VIZSF).

Vizsla saw its share price tumble as low as $.24 at the depths of the market crisis in March, only to surge higher by more than 1,000% over the next four months as management executed at a very high level and managed to deliver a stunning discovery hole at the Napoleon Vein Corridor in July (8,078 g/t silver-equivalent over 6.0 meters). Vizsla is cashed up with C$27 million in the treasury and the company is aggressively drilling Panuco with 5 drill rigs active across the property.

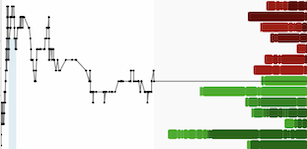

VZLA.V (October 2019 - November 2020)

VZLA's share price has settled down in the $1.50 area in recent weeks after precious metals sector sentiment has cooled off considerably. I felt it was a good time to catch up with Vizsla CEO Mike Konnert and reassess the opportunity that exists in VZLA shares today.

Goldfinger: It’s good to catch up with you today Michael. I remember when we spoke for the first time, it was a little over a year ago, and a lot has happened since then. The first question I want to ask you is, if you were told that Vizsla Resources would be where it's at now, in terms of the results and the progress and the cash in the treasury, if you were told this last November, how would you feel?

Michael Konnert: I would feel incredibly proud and I do feel incredibly proud of what we've accomplished in such a short period of time.

Goldfinger: Let's do a quick summary of what you have accomplished in the last year and then we'll talk about where you're going. I know that the year started off a little bumpy with the COVID shutdown, but you guys managed to renegotiate the terms of the option agreement on the project. And then you managed to get back out there in May and June and really hit it hard and obviously have a little luck with the drill, and you also had a favorable environment in the precious metals sector. And during the summer you guys managed to raise C$30 million and you have five drill rigs going right now. So why don't you summarize the results so far this year?

Michael Konnert: Sure, the COVID shutdown actually created a significant opportunity for us. When we first got to the project we were certainly new to the district. And so through prospecting, sampling and mapping and that type of thing, we were able to determine some drill targets and we originally drove the ones that we thought were the best.

And it turned out that those results on the Animas area weren't the greatest and nothing like what we were later to encounter, but that COVID shut down was actually a challenge that we turned into an opportunity, and the opportunity was to kind of slow down and take a bit of a breather with our geology team and analyze the data we had and talk to people on the ground, the legacy miners in the area, and get a bigger understanding of what this district had to offer.

And that in turn, created the pathway for us to make that discovery at Napoleon, which I think is one of Mexico's top five drill results in many years, it's spectacular. And that hole was, of course, hole seven at Napoleon, which was six meters at over eight kilograms silver-equivalent. And so in that the breakdown was not only just high silver numbers, but really great gold. So the breakdown was 1.8 kilograms of silver and over two ounces of gold, 66 grams/tonne gold, and then some incredible base metal numbers as well. So, that was such a fantastic moment, certainly in my career and also for the company to have that discovery.

And of course on the back of that, that was kind of the moment everything changed for Vizsla. Moments after announcing that hole, we were rounding up $30 million from Eric Sprott and other great funds like Franklin Templeton and Fourth Sail Capital out of Brazil. So, that discovery was just so impactful for the opportunities and for the future of the company. We subsequently went on to make many more multi-kilo discoveries over good widths and actively drill the district with five rigs while creating a lot of value for shareholders over the last six months.

Now, yesterday we announced the new discovery at Cordon del Oro at the Aguita Zarca zone, which ... that in itself is actually really quite impressive. It's giving us a broader width of a great grade, so 18 meters at 449 grams/tonne silver equivalent, basically in a zero strip environment where this is an oxide cap on top of the ore chute that we see below. So, this Cordon del Oro area has totally opened up for us now.

Goldfinger: I was looking at the news yesterday and I was looking at the map in the presentation which summarizes the drilling and discoveries you’ve made to date. It's really quite striking when you look at what you guys have managed to accomplish in such a short period of time. You’re finding multiple extensive high grade vein zones, and this is sort of what we discussed in our first couple of conversations, you said, "Look, we think we have a district scale project on our hands, and we're going to prove that there are a lot of ounces at Pancuo and we're going to prove it pretty fast."

And so obviously it's too early to put a resource on Panuco, but I remember talking to some smart guys earlier this year, in the February/March timeframe, they said "If Vizsla can, outline 40 million ounces at an average of 500 grams silver or better, this is going to be an economic project, it's going to be a very profitable mine." Where do you think you are at in terms of a global resource at Panuco at this point?

Michael Konnert: Well, I guess a good way to explain this is our targeting of ore chutes and prospects and targets has evolved now over the last few months. And so what we're doing is if we have a drill rig on a prospect, we're either making that initial discovery, and if we've made that initial discovery and we're still drilling it, it means it has the potential for one of these ore chutes to have five to 30, 40 million ounces in them, which we've seen on the Animas vein. It's actually kind of funny when we look at the district and that Animas structure, which is the three and a half kilometer vein corridor that has eight ore chutes on it that have been mined out, that gives us the template to what we're really looking for. It's almost a bit of a cheat code to see, "Well, okay, how did this occur on Animas and can we see this happening on Cordon or Napoleon?"

And it's not 43-101 compliant. This is not a resource or anything that I'm about to state here, there's all these caveats that I have to make, but we would estimate that about 100 million ounces of silver have come out of that Animas vein corridor there. And so some of these ore chutes have produced 10, 20, 30, possibly even up to 40 million ounces of silver from just the one or two nearby ore chutes.

And so for us, to look at what a resource is, to see that pathway to that initial 40 million ounces of silver, possibly 50, onward to 100 million ounces in this district, which I'm confident that we'll eventually be able to demonstrate that, and of course we're drilling so aggressively that that may happen sooner than later, but for us, if we're drilling something past the discovery, we think there's a chance for that to have significant resources. And for us, the name of the game is to build this resource very rapidly. And that's why we're drilling with five rigs right now. And I think in 2021, there may be new announcements on bringing more rigs to the project.

Goldfinger: So you've got five rigs going right now. I can only imagine how much core you guys have in the lab that's still being processed. So we're going to have news flow basically every month now. There's going to be a lot of news coming. Can you tell us where the rigs are right now and what they are targeting?

Michael Konnert: Well, certainly. Our five rigs are spread over three different areas right now. So two rigs are on the Western portion of the project, which is the Napoleon vein corridor. And if you remember what I was saying about Animas being that three and a half kilometer vein corridor with eight ore chutes on it, Animas is a two kilometer vein corridor that we have outlined so far from our own prospecting. And we're drilling certainly one ore chute in the original Napoleon discovery. That was that six meters at 8,000 grams/tonne silver-equivalent. Later, we drilled at depth, actually, we drilled some fantastic holes there, 15 meters true width of about 440 grams silver equivalent there, and a number of other really great widths and high grades at depth there.

That one's coming along. We have a drill rig working on what would be described as resource drilling on the Napoleon proper there, but we're also drilling at the Papayo zone, which is a kilometer to the north of that original discovery. And the Papayo zone looks to look to us as if it's forming into something that's quite compelling and certainly demands more drilling and has the potential to be a meaningful ore chute in terms of resources.

So two rigs on Napoleon right there drilling off, I guess, I suppose you refer to that as resource drilling there. Now, we also have a drill rig about half a kilometer to the east from that original Napoleon discovery at a target called Tajitos. We have one rig on Tajitos, and Tajitos had some spectacular high-grade multi-kilo numbers over a good width there. And it's an old mine working area. We think that there's the potential for that to be a meaningful ore chute as well, too, so we're drilling there.

And now we have two other rigs, the central eastern portion of the project, and that's this most recent, very, very exciting opportunity that we've uncovered here with that Aguita Zarca zone on the Cordon del Oro vein corridor. Now, Cordon del Oro was really interesting to us and we actually spent months drilling there and just ... it was a lesson in perseverance. We spent months drilling there, and we didn't have the joy that we wanted at the Animas target, but we kept drilling, looking at different ways to succeed there. And Charles and his team have done an excellent job in drilling with our portable rig at Aguita Zarca.

Now, Aguita Zarca and the Cordon del Oro corridor itself is really quite interesting because it is an analog to Animas, it's across a valley from Animas, and has a lot of the characteristics that we see at Animas, we see at Cordon del Oro. It's high up in the system, so there's the potential for there to be significant depth to any ore chutes that we find there. And of course, this new recent release of this oxide cap, let's call it, on top of other mineralization is very exciting because it's essentially the hillside to the west of the El Coco Mill that we have under option. So it's kind of funny to think about your ore just coming down the hill there to the mill, but it could be very profitable for us.

And then we have the final rig, the fifth rig that is drilling down at the Peralta target, which is up the Southern portion of Cordon del Oro. And that one, we're a bit early on that one, but that one seems to be quite promising as well, too.

Goldfinger: So you have four main zones (Napoleon, Cordon Del Oro, Papayo, and Tajitos) that you're targeting right now. And you said you might add additional rigs next year, is that to explore the rest of the property?

Michael Konnert: Well, we will be releasing by the end of the year, we expect to release a press release that will describe some of the prospecting work that we've been doing across the district. And by no means have we exhausted the prospectivity yet, actually it's quite the opposite. We have so many targets that we're undertaking the exercise of ranking and prioritizing what we can deem to be the next pathway to five to 10, to 20, to 30 million ounces of silver in a discovery.

So, the next rigs that we bring on may be focused on resource drilling, but a certain portion of them, and certainly a meaningful amount of any other drill rigs to come to the project will be up there. I suppose you could call it wild scouting for silver in this district. Like you pointed out, in over a year, we've transformed this company because of discoveries. As a matter of fact, it was only in the last six months. And there's other discoveries out there. It's high value dollar to spend, high reward dollar to spend drilling in this district.

Goldfinger: To put it from a shareholder standpoint, you guys started trading October 2019 at C$.40 a share, and in July VZLA shares traded at nearly C$3.00. So that's nearly a 10 bagger, I think it was actually more than a 10 bagger from the March lows. And now obviously, the sector doesn't have as favorable of an environment as it was a few months ago, and the stock has pulled back about 50% from the July peak, it's trading at about a C$100 million market cap. But when you look at the value proposition now, for me, I see C$30 million in the treasury, you've got five rigs going, you've outlined more new discovery zones. Now we're going to have steady news flow with the potential for more new discoveries. It seems like it's a pretty reasonable valuation and quite attractive. What option payments does Vizsla have to make in the next year? What's the cash balance right now, and how would you characterize this value proposition from about C$1.45 a share?

Michael Konnert: I think it's exceedingly cheap right now. So our cash position, we'll end the year with about C$26 million in the bank, that'll leave us funded for all of 2021 ... looking to spend possibly around C$15 million drilling in 2021, and, well, how do you compare that to what the upside is? Or how do you quantify the upside? Well, I would say that any one of these discoveries would be, in its own company, would be very attractive. The Napoleon discovery itself, or even that Papayo area, if you broke that off and put it into its own company, you'd support a significant market cap with just that. Now, of course, we've got an entire district that's never been explored before in a meaningful way. And we're the first group to do that. Now, the hard work here is done. The consolidation of the district is the hardest part to do. It took me a year of constant travel to Mexico, and many failed attempts at it, and perseverance paid off. We certainly wouldn't be able to do this deal today at mid $20 silver.

Now, we're all paid up on the options. We don't have any payments until 2022. And so we're in great shape there, but the big thing for Vizsla and why I believe it's so undervalued is that we're going to continue to make these discoveries. We're well-funded, we're well backed. And we have this opportunity to move faster than any of our peers into production. Now, in a rising metal environment, the multiples that a company like Vizsla would get for production profile of reserves are very attractive. Silver has higher leverage to gold, and you can look at companies like First Majestic, or even Silvercrest, at their billion and a half dollar market cap in proportion to their resources. High-grade silver carries a huge premium. And for us to not only have high-grade silver, but have an entire district of high-grade silver, but also have the mill and the permits and the option agreements and everything that we would need to be an operating silver mining company right there in one company. I think the rerating potential on success is very strong here.

Goldfinger: There’s no doubt that you have done the heavy lifting in 2020 in terms of making the new discoveries, in terms of making it through the pandemic and actually excelling in an otherwise challenging environment. By raising significant capital at favorable share price levels you have put yourself in a position to really advance this project rapidly. The management execution has been very strong from my vantage point and I think if we went back to last November and we could see where Vizsla is today, it’s been an incredibly successful year all around.

What can we expect from Vizsla over the next couple months? I know you said there's going to be a big news item coming out next month outlining property-wide prospecting and exploration plans.

Michael Konnert: Yeah, certainly. And first of all, thank you for those kinds of words there. We appreciate that you've followed us and been supportive of us as we've been building this company. So I appreciate that, first of all, and our plans for next year, for news in this upcoming ... call it two, three months ahead here is really about drill results and the prospectivity of the district, giving investors and the market a pipeline of targets basically outlining what are those steps to building that resource that really underpins the value of the district here and gives us the ability, although we're very comfortable right now to exercise the options and own the mill and own the entire district 100%, that's something that we'd be comfortable with, it's still ... I think the market still needs to see the pathway to those resources.

So for us in the next few months here, it's really all about drill results, showing the pipeline of prospects and possibly some other corporate news in the sense of working on options and things like that as well. But we're certainly focused on just delivering more and more high grade silver from the project.

Goldfinger: So the bigger option payments are about 18 months away. Is there any possibility to exercise that option a bit early? What, for you, is a major milestone where you go to the board and say, "Okay, it's time to execute the option to take full ownership and really move this thing forward rapidly?"

Michael Konnert: Well, I think absolutely that is a conversation that we have, and I would say that we are moving things forward quite rapidly and even with our intentions to look at the district ownership. Without saying too much and for certain reasons, we're working on it, I would say. Working on different options on how to make that ... how to clear up the ownership and create a hundred percent ownership for Vizsla. But I would say that the aggressiveness with which we're drilling the district, I think shows that sense of an urgency to really make this district perform and own it a hundred percent.

Goldfinger: As a shareholder myself, I would say that this stock is probably in my top 10, possibly even my top five for end of year buying, adding to my position. I know there's probably some people out there that bought above $2 and maybe even higher than that during the summer might become a little bit of a tax loss selling target or opportunity to add on people selling for their own reasons that have nothing to do with the value of the company or its future prospects. I think that from a technical chart perspective, this C$1.30-$1.50 area is an attractive area of support. And then when you just look at the value proposition and then the catalysts that could unlock a lot more value relative to the downside, I think it's a pretty attractive set up.

And I think it's important for investors to put things into perspective, bigger picture. I mean, obviously if you bought stock at $2.80 and it's trading at $1.45, you're not terribly happy, but when you look at Vizsla from its inception at 40 cents a share to $1.46 here this afternoon, and all the company has accomplished I think it’s a great success. The cash in the treasury is huge, you're fully funded for the next year, you don't have to be at the whim of the market. I think that's very attractive, and this management team has performed at a very high level during a fairly challenging year for pretty much everyone. So I think it’s a great opportunity to add or start a new holding in Vizsla in the next 30 days. So thank you for your time this afternoon, Michael, I appreciate it.

Michael Konnert: Thank you and I’d like to thank you for your support and appreciate you being a shareholder as well as your kind words about the progress of the company, too.

DIsclosure: Author owns VZLA.V shares at the time of publishing and may choose to buy or sell at any time without notice. Author has been compensated for marketing services by Vizsla Resources Corp.

DISCLAIMER: The work included in this article is based on current events, technical charts, company news releases, and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. This publication is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.