Globex earnings from operations for Q3 2020 appeared to be an extreme outlier for the company and may signal that, after many years and several cycles, the company is on the verge of harvesting significant value from its vast portfolio. The subsequent agreement to sell Mid-Tennessee to Electric Royalties has yet to close but provides further evidence that Globex may, finally, be moving into a self-sustaining growth phase.

It’s hard to imagine how this was ever a 14 cent stock with a $6mm market capitalization. The company earned $5.9mm from operations in Q3 - nearly the entire market capitalization of the company at its stock-price-low.

Even today the market cap seems modest, just $50mm, for the apparent earning power in the Globex portfolio.

The Globex model has always been difficult for investors to untangle. The company presentation describes Globex as a “Mineral Property Bank” but it might just as easily be called a prospect generator or a royalty generator. Globex has also, from time to time, engaged in exploration drilling.

The “royalty generator” model is new language around an old concept. The project generator model was named and popularized by Rick Rule decades ago. There have been a few impressive successes: Virginia Gold, Arequipa, Mirasol, Almaden, Francisco Gold. These companies preserved capital through project generation but pivoted to sole-risk exploration on discoveries that created high stock prices and delivered cheap risk capital. Perhaps even more impressive though, has been the success of Altius Minerals ($ALS) and EMX Royalty ($EMX).

Altius and EMX started their corporate lives as prospect generators - acquiring prospective properties and partnering them in return for equity interests. For both companies, early exploration success took their stock prices higher and both companies used this lower cost-of-capital to make royalty purchases. Altius spent $13.6 mm to purchase a fraction of the prospector royalty on the Voisey’s Bay Nickel deposit while EMX paid $45.8mm to acquire Bullion Monarch for several Carlin Trend royalties - with Leeville as the most substantial.

The early royalty purchases proved to be opportunistic - rather than a new model. Altius and EMX continued to generate and partner projects with the intent of harvesting equity gains and developing royalties organically. Altius had rapid success assembling the valuable land package employed in the creation of Aurora Energy. The company’s equity stake in Aurora generated gross proceeds of over $200m. EMX enjoyed similar success with the sale of its Russian copper/gold interests for net proceeds of approximately $69mm USD.

In addition to these headline successes, Altius and EMX have systematically built diverse portfolios of royalties and equity interests in return for vending claims or, for making strategic equity investments. The net result is that both companies have had impressive gains from their IPO prices: Altius went public in a 1997 IPO at 20 cents and is now $17 while EMX came public through an RTO in 2003 at around 60 cents and now trades for $4. Fantastic returns.

The junior royalty space has been experiencing hyper-growth in the last several years. With the success of Maverix ($MMX) and Metalla ($MTA), scores of new issuers have been listed. The most successful “fast-follower”, Nomad Royalty ($NSR), has neared $1bln in market capitalization since listing in June of 2020.

The online media outlet Crux Investor recently did a series of interviews with junior royalty companies. The recurring themes were rapid creation of new junior royalty issuers and the skyrocketing price of quality royalties.

Buried within the excitement, EMX Royalty and Altius Minerals, have enjoyed steadily rising profiles and valuations. Investors are beginning to appreciate the value that has been created and the latent value in their maturing property and early-stage royalty portfolios.

For Altius and EMX the durable move from penny-stock to dollar-stock occurred after the first major monetization. Altius crossed $100mm market cap threshold after selling out of Aurora -reaching a staggering $800mm in 2007 - and EMX trades regularly above the $300mm market cap since the sale of Malmyzh.

Globex may now be on this threshold.

The Globex portfolio of 193 properties with 73 royalties is mostly in the Abitibi – a highly prospective and coveted jurisdiction. On a basic level the Globex portfolio constitutes the important raw materials for the creation of exploration companies and possible discoveries. A typical Globex transaction involves the sale of a property for cash, stock, a royalty or – in many cases – all three.

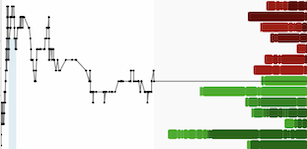

Here is a snapshot of income and deals in Q-3 2020

Since these results were reported Globex agreed to sell its Mid-Tenessee gross metals royalty for $13mm in cash and approximately $5mm in shares of Electric Royalties. The transaction appears to be on track to close.

Rarely does a month pass without a news release reporting progress on a Globex deal or property – but investors should be sure they look past the headline and read to the end. As an example, on March 31 Globex reported receipt of the initial $250k instalment from ELEC. The news release goes on to report four separate deals with various junior companies for cash, stock and retained royalties. Globex is a deal machine.

After many false starts since 2016 we appear to be in a positive commodity cycle. Precious metals have been strong since June of 2019 and base metals have been steadily appreciating as infrastructure and green technology become a focus of governments worldwide.

For Globex shareholders this cycle is off to a promising start. Cash proceeds of approximately $16mm, stock proceeds of nearly $10mm and numerous royalties created and retained. The company is doing deals constantly - these figures will likely be stale when read.

Globex has likely passed the point of ever needing to issue new equity. For Altius and EMX, crossing this important threshold signaled the commencement of dramatic share-price appreciation - both companies went on to add hundreds of millions of market capitalization.

For Globex it may be just the beginning – 40 years in the making.

Disclosure - I own Globex