Closed-End Funds - Queens Road (QRC) and Torrent Capital (TORR)- Leading Edge or Rare Species?

Queen’s Road Capital - https://ceo.ca/qrc

Warren Gilman has been ubiquitous in the digital world lately telling the Queen's Road Capital story. Warren is a former investment banker who left the sell-side over a decade ago to manage money for Hong Kong billionaire Li Ka-Shing. In 2019 Warren converted Lithion Energy, a TSXV shell, into a Cayman domiciled investment issuer with the stated purpose:

“...to invest its capital in resource companies and projects on a global basis with an emphasis on convertible structures such as convertible debentures. The focus will be on issuers with assets in production or near production in safe jurisdictions. QRC expects to return a significant portion of the annual coupon on its interest-bearing investments to investors in the form of dividends, with the balance of the interest retained to cover costs and for investment in new opportunities.

As the traditional financial markets for resource issuers have deteriorated, there is increased demand from resource issuers for alternative sources of funding to advance and develop their projects. QRC is seeking to fill this void and help build the next great resource companies and mineral projects.”

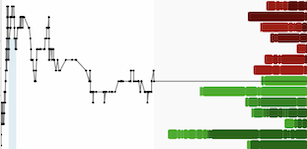

If you were paying attention you might have caught a bit of this ride:

Torrent Capital - https://ceo.ca/torr

During 2016, in a transaction with some similarities to the Lithion/Queen’s Road transformation, Wade Dawe repurposed Metallum Resources into the investment issuer now known as Torrent Capital:

“...Metallum Resources Inc. (TSXV:MRV) (“Metallum” or “Company”) is pleased to report that it has received conditional approval from the TSX Venture Exchange for its change of business (“COB”) from a Mining Issuer to an Investment Issuer. On a going-forward basis, subject to necessary regulatory and shareholder approvals, Metallum will focus upon strategic investments in private and public company securities.”

Keen observers in this story had to wait a bit longer than Queen’s Road investors but patient holders have been well-rewarded:

What Gives?

Experienced investors should forgive themselves for being skeptical. Closed-end investment vehicles have all but disappeared - replaced by ETFs. A few notables remain - Berkshire Hathaway being the most famous of all. It would be easy to forget that Brookfield, formerly Brascan, was once an investment holding company for members of the Bronfman family.

Listed closed-end funds were, among other purposes, a solution to the mismatch between investors’ personal liquidity needs and the longer duration required for certain investment opportunities to bear fruit. The problem was that the vast majority of them traded at significant discounts to their NAVs. This wasn’t always true. Narrowly focused funds in hot sectors have occasionally traded well above NAVs. Canadian resource investors will remember Pinetree as a recent example.

Stock Picking - a Quaint Relic…?

Today’s investor has been trained to believe that any benefit from active management of portfolios is negated by the fees charged. This may be true across the investment universe on average but it is demonstrably untrue for individual portfolio managers.

Further, within specializations like resources or microcap - index investing is very unlikely to beat active management. Indexes like GDXJ are constructed with a focus on size and liquidity to ensure that ETF products based on them can more easily trade in line with the underlying basket of stocks. Paradoxically, GDXJ inclusion is often the culmination of a successful investment for a junior resource stock investor. Consider, Klondex, Gold Standard Ventures, First Mining Finance. All have yet to return to the stock prices achieved around their inaugural inclusion to the index.

Preoccupation with indexing and recent investment industry regulation changes have acted to restrict investment in illiquid securities. Combined, they have starved the resource and microcap sectors of the capital needed to advance ventures that do not monetize quarterly.

Into the Void

With traditional investment vehicles becoming less suited and less apt to invest in resources and microcap the opportunities for QRC and TORR have been abundant. The portfolio managers for Torrent and Queen’s Road have, so far, have made excellent investment selections.

Wade Dawe - Torrent Capital

Many resource investors will remember Wade Dawe as the CEO of Brigus Gold when it was sold to Primero. Wade is certainly expert in constructing and directing resource companies but his record of early-stage investing in sectors like life sciences and software has been impressive. Wade is not the portfolio manager for Torrent but, as the CEO, he has been the source for many of Torrent’s best investment ideas.

The Torrent NAV has benefited from dramatic appreciation in several early-stage names: Kneat.com (KSI), Sona Nanotech (SONA) and Martello Technologies. Each has returned multiples on the initial investment.

The most successful ideas in the Torrent portfolio have come either through direct involvement by Wade in bringing the deals public or through Wade’s connections with other successful investors like Sir Terry Matthews and Bruce Linton.

Investments of this nature are often in private rounds and, generally, are not broadly available. An investor in Torrent, therefore, gains access to high-potential early-stage deals and benefits from the filter applied by Wade and his team.

It’s important to note that Torrent’s investment targets are often high-risk. One investment, Aguia, appears to have been a near-total loss.

Warren Gilman - Queen’s Road Capital

Warren may be unknown to many individual investors but he is well known and well respected in the banking and finance community.

Warren was an investment banker at CIBC who, along with partner Don Lindsay - now CEO of Teck -, was involved in many high-profile transactions. Readers of “The Big Score” by Jacquie McNish may remember that Warren and Don worked with Falconbridge on their bid for Diamond Fields and the great Voisey’s Bay nickel discovery. Lesser known is Warren’s role in acquiring Niobec from Iamgold in 2014. The acquisition, fronted by Aaron Regent and Magris and funded by CEF and Temasek, will likely go down as one of the best transactions made during the mining sector’s long bear market.

Warren’s ability to identify the best projects for investment is unquestionable but an investor in Queen’s Road is provided with some other interesting advantages. Seed funding for Queen’s Road was north of $80mm, giving it the all-important scale required to write transformational cheques. The company has paid no commissions to raise capital nore does it charge management fees to shareholders. It is Cayman domiciled for maximum tax efficiency. More capital is likely to be available from Australian billionaires Jack Cowin, Andrew Forrest and Brett Blundy if needed. The company could also tap capital markets.

Queen’s Road structures its investments in an exceedingly clever fashion. Most investments are in the form of Convertible Debentures. These debentures are designed to be equity-friendly so that the target companies can continue to access capital from common stock issuance at beneficial prices.

Income from the convertible investments made by Queen’s Road will eventually be paid as dividends to shareholders. If projects take longer then dividends will last longer. The convertible feature of the debentures will offer equity returns after the 30% issue premium is exceeded.

Generally, Queen’s Road must be the sole creditor meaning that, in theory, a loss could only occur if the project value falls below the par value of the debenture. Other features like payment-in-kind, warrants and establishment fees also add to investor returns.

Queen’s Road has made investments in Nexgen Energy, Adriatic Metals and ISO Energy. The common thread between these investments is that they are world-class ore bodies that have or are expected to generate impressive economics.

The Bottom Line

An investment in either company gives a shareholder access to opportunities that would not otherwise be available to them. It also provides access to expert and well-connected investment managers.

The cost is liquidity. If you want to sell the market will need to provide a buyer. This last problem has an important corollary - redeeming investors will not force the sale of promising longer-term investments.

If you like doing your own idea generation and investing then you need not consider investing in either of these companies but keep an eye on their portfolios. Wade and Warren are doing great work.

A nice video on QRC:

https://www.youtube.com/watch?v=l2PrsD9V4-c

Disclosure - I own shares of Torrent